Table of Contents

TL;DR

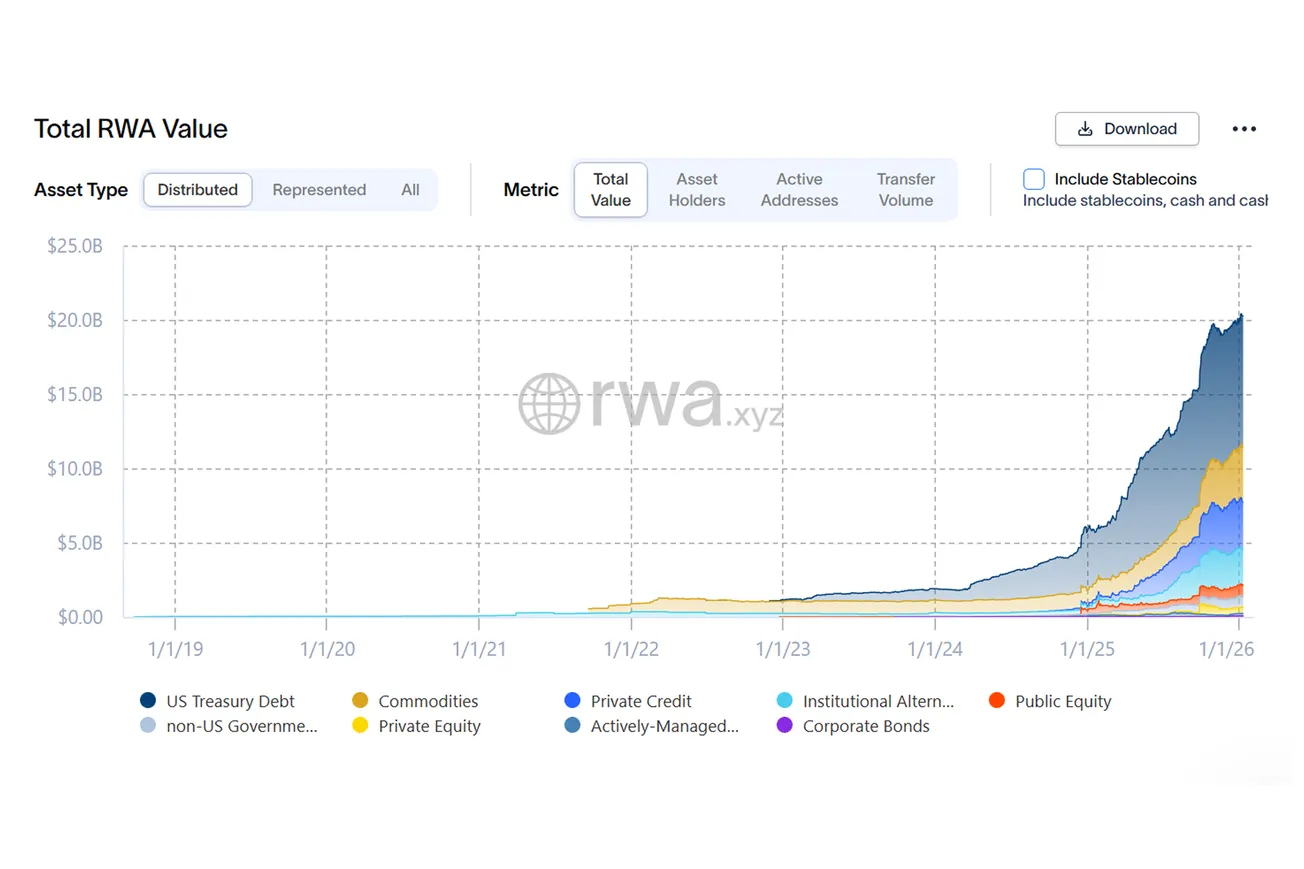

- On-chain RWAs (Distributed Asset Value) are $20.69B, up +$1.44B (+7.48%) vs last week — this is a real jump, not the usual slow drift.

- Participation keeps expanding: 620,051 wallets hold RWAs, up +17,011 (+2.82%) WoW — adoption is still broadening, but capital grew even faster this week.

- Chains: Ethereum stayed the value anchor (almost flat), while BNB Chain and Solana did the “growth work” (value + holders). Stellar looks more concentrated: value up, holders down.

- Commodities: market cap $4.43B (+9.93% WoW) and active addresses +17.33% WoW — this week looks like both more interest and more usage.

- Stablecoins: $297.73B (–0.10% WoW), but 220.44M holders (+1.38% WoW) — value is flat, reach keeps widening.

Market snapshot (as of 12 Jan 2026)

| Metric | Value | 7-day Δ |

|---|---|---|

| Total on-chain RWAs (Distributed Asset Value) | $20.69B | +$1.44B (+7.48%) |

| Holding addresses (RWA holders) | 620,051 | +17,011 (+2.82%) |

| Active issuers (tokenization platforms, proxy) | 137 | +8 (+6.20%) |

| Stablecoin backdrop (total value) | $297.73B | –$0.31B (–0.10%) |

| Stablecoin holders | 220.44M | +2.99M (+1.38%) |

How to read this: stablecoins are held by 220.44M addresses, so the user base for “settlement money” is still far broader than the RWA holder base (≈ 356×). By value, RWAs are about 1:14.4 versus stablecoins — the rails remain much bigger than the cargo.

Sources behind the 7-day deltas: RWA.xyz snapshot (01/12/2026) vs last Monday’s weekly snapshot (05 Jan 2026).

Chain dynamics

The headline this week is the shape of growth: value popped (+7.5%) while wallets rose more slowly (+2.8%). That usually means the market wasn’t just onboarding new small holders — it also saw bigger allocations (or a few large products expanding) somewhere in the stack.

What’s interesting is where that expansion showed up:

- Ethereum: still dominates value, but this week it looked more like “more users, same pile.” That’s not bearish — it often happens when growth is happening elsewhere first, then settles back into Ethereum later.

- BNB Chain: moved from last week’s “wallet wave” into a proper wallet + value week. That’s the pattern you want to see if onboarding is converting into allocation.

- Solana: kept the strongest “balanced growth” profile (holders and value both up meaningfully). It still looks like broad participation, not just one big wallet.

- Stellar: value rose while holders fell — the simplest read is concentration (fewer wallets, larger average positions). That can be healthy, but it’s a different risk profile than “many new holders.”

Top 5 networks by RWA Total Value (excl. stablecoins) — with 7-day % in brackets:

| Network | RWA holders | RWA total value (excl. stablecoins) |

|---|---|---|

| Ethereum | 145,639 (+1.76%) | $12,734,229,287 (+0.02%) |

| BNB Chain | 11,556 (+22.07%) | $2,021,657,058 (+8.87%) |

| Stellar | 4,563 (–6.07%) | $994,329,473 (+10.91%) |

| Solana | 139,681 (+9.30%) | $942,729,660 (+8.02%) |

| Arbitrum | 3,745 (+0.78%) | $753,897,142 (+3.80%) |

Note: Liquid Network currently shows ~$1.01B RWA value (excl. stablecoins) and sits between BNB Chain and Stellar by value, but holder data is not shown in the network table. Current network data is as of 01/12/2026 on RWA.xyz; 7-day deltas are computed vs 01/05/2026.

Commodities (tokenized gold, etc.)

Last week commodities looked “busy” (activity surged more than market cap). This week, it looks more like activity + size moved together — a stronger signal.

- Market cap: $4.43B (+$0.40B, +9.93% WoW)

- Monthly transfer volume: $5.21B (+$0.46B, +9.68% WoW)

- Monthly active addresses: 27,162 (+4,012, +17.33% WoW)

When addresses rise faster than market cap, it often means the asset is being used in more “small-to-medium” flows (rebalancing, settlement, moving collateral), not only a few large buys.

What to watch into late-January 2026

- Does “>$20B” hold? This week’s jump is big. If next week stays near this level, it’s structural; if it mean-reverts quickly, it was a burst (or a one-off flow).

- BNB follow-through: holders were up 22% and value up ~9% WoW. If that repeats even at a slower pace, we’re seeing real rotation.

- Stellar concentration: value up, holders down can be “bigger positioning,” but it also increases dependence on fewer wallets. Watch if holders stabilize next.

- Commodities staying “used”: addresses are up 17% WoW. If that persists, tokenized commodities keep moving from “store of value” into “on-chain utility hedge.”

- Stablecoin breadth: holders keep rising even when value is flat. If stablecoin value turns back up, RWAs usually get more liquidity “room” to expand.

Bottom line

As of January 12, 2026, RWAs had a noticeably stronger week: value +7.48% WoW while holders +2.82% WoW. Ethereum stayed dominant but quiet (flat value), while BNB Chain and Solana did most of the visible growth work. Commodities also strengthened in both size and usage, and stablecoins kept expanding in reach — the same foundation RWAs usually build on when the next leg of growth comes.