Table of Contents

TL;DR

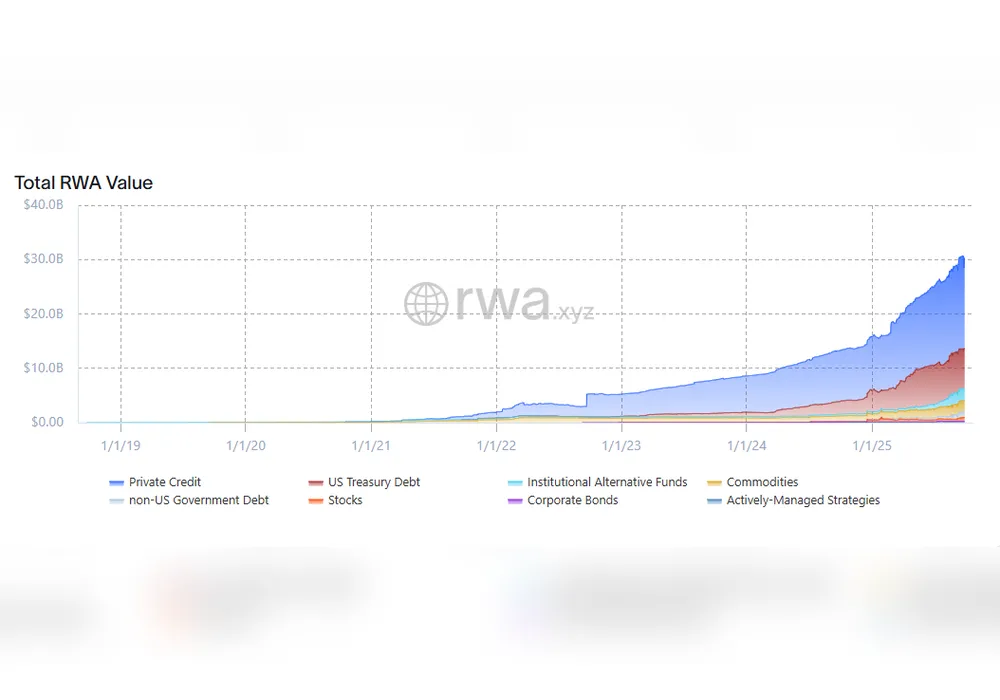

- New record: on-chain RWA value pierces $30.39 B (▲5.7% MoM).

- Holder count crosses 406 K (▲9.2%), underscoring retail momentum in spite of rising Treasury yields.

- Superstate’s USTB explodes past $550 M (▲107% MoM), becoming the #2 Treasury wrapper.

- Silver, gold & oil rally together: PAXG tops $1.1 B, XAUT nears $930 M, while SLVon leaps 37% WoW.

- Chain race reshuffles again: Avalanche & Solana each add >35% TVL; Ethereum still claims 52% but trendline keeps drifting lower.

- Stablecoin float rebounds to $288.8 B (▲5.9%), erasing last week’s redemptions.

Market snapshot

| Metric | Value | 30-day Δ | Note |

|---|---|---|---|

| Total RWA on-chain | $30.39 B | ▲5.72% | Fresh ATH |

| Addresses holding RWAs | 406,523 | ▲9.22% | Retail broadening |

| Active issuers | 221 | +16 | New launches outnumber takedowns |

| Stablecoin TVL | $288.81 B | ▲5.93% | Rail capacity expanding |

Treasuries: momentum flips bullish

| Wrapper | TVL | 30-day Δ | Comment |

|---|---|---|---|

| BUIDL | $2.13 B | ▼11% | Still #1 but losing share |

| USTB (Superstate) | $551 M | ▲107% | Breakout aided by cheap Solana rails |

| USYC (Circle) | $637 M | ▲18% | Reverses last week’s outflow |

| WTGXX (WisdomTree) | $557 M | ▼37% | Fee anxiety drives exits |

| ChinaAMC CUMIU | $502 M | ▲67% | Asia bid persists |

| ULTRA (Libeara) | $136 M | ▲79% | Yield-maxi magnet |

Aggregate Treasury float climbs back above $7.3 B even as the mix tilts toward lower-fee, multi-chain offerings.

Credit, carry & alternatives

- JAAA steady at $783 M (▲4% MoM) despite modest CLO spread widening.

- USCC cracks $249 M (▲20%), signalling renewed risk appetite for delta-neutral carry.

- Midas mF-ONE tops $128 M (▲127%), riding transparent NAV and weekly liquidity promise.

- First Libeara thBILL ($11.6 M) and Tokeny’s Legion Strategies ($218 M) debuts highlight diversification beyond USD Treasuries.

Chain dynamics

| Rank | Chain | RWA TVL | 30-day Δ | Share move |

|---|---|---|---|---|

| 1 | Ethereum | $9.06 B | ▲3.4% | Share ↓0.9 ppt |

| 2 | zkSync Era | $2.42 B | ▲1.1% | Flat |

| 3 | Polygon | $1.12 B | ▼2.1% | Minor fade |

| 4 | Avalanche | $728 M | ▲37.6% | ETF-fuelled surge |

| 6 | Solana | $669 M | ▲36.5% | USTB & MSTRx inflows |

| 7 | BNB Chain | $519 M | ▲31.2% | Treasury vault adoption |

Takeaway: Alt-L1s with cheap finality and native CEX connectivity are siphoning marginal flows, though Ethereum remains the liquidity anchor.

Commodities & metals shine

- PAXG closes the week at $1.10 B (▲14% MoM).

- XAUT inches to $928 M (▲10%).

- SLVon rockets to $4.80 M after WisdomTree’s silver-backed ETF tokens go live (▲37% WoW).

- Oil (JSOY_OIL) stabilises at $307 M after an earlier dip, mirroring spot Brent consolidation.

Gold & silver now represent 6.8% of total RWA TVL—highest since tracking began.

Equities & thematic ETFs

- MicroStrategy xStock (MSTRx) logs the week’s biggest transfer flows and jumps 33% WoW to $7.25 M as BTC rallies.

- ETF tokens (SPYon, IVVon, QQQon, TLTon) collectively add $9 M+ AUM, validating the 24/7 trading thesis.

- Blue-chip equity tokens (NVDAon, MSFTon, METAon) see double-digit AUM gains, benefiting from US tech rebound.

Behaviour insights

- Ticket-size downshift: address growth outpacing TVL indicates smaller allocations per wallet—retail-led expansion.

- Issuer resurgence: 16 net new issuers in September, reversing summer attrition.

- Fee sensitivity: wrappers trimming management fees (e.g., Superstate) capture outsized inflows versus static-fee peers.

Forward watchlist

- GENIUS Act progress in US Congress could fast-track stablecoin payment rails, indirectly juicing RWA demand.

- Brazil & APAC tokenization bills under consultation—look for agri-commodity and FX-linked RWA launches.

- Solana ETF filings: approval would likely catalyse fresh flows into SOL-native wrappers.

- WisdomTree’s TECHX & SPXUX inch toward $20 M combined; sustained growth could legitimize thematic equity baskets on-chain.

Bottom line

September closes with RWAs breaking above $30 B for the first time. The market is no longer a single-chain or single-product story: multi-chain Treasury wrappers, precious-metal tokens, and 24/7 ETF rails are driving the next leg of adoption. With regulatory tailwinds and issuer pipelines filling, the path toward $35 B now hinges more on execution speed than on market conviction.