Table of Contents

TL;DR

- On‑chain RWAs hit $34.14B, up 10.6% over the past 30 days, reaffirming sustained demand for tokenized real‑world exposure.

- Holders: 489,037 (+6.7%) — growth continues, reflecting strong institutional and retail participation.

- Treasuries remain the heavyweight class: BlackRock’s BUIDL, Superstate’s USTB, and Franklin’s BENJI lead inflows. Rotation intensifies between wrappers as investors chase optimal yield and cost structures.

- Gold dominates: XAUT $1.66B (+84%) and PAXG $1.36B (+29%) drive the commodities rally. SLVon (tokenized silver) doubles to $7.07M.

- Ethereum strengthens its lead to 58.2% market share (+21% MoM), Arbitrum soars +122%, and Stellar +23% as multi‑chain tokenization deepens.

Market snapshot (as of Oct 20, 2025)

- Total RWA on‑chain: $34.14B (+10.58%)

- Holders: 489,037 (+6.71%)

- Issuers: 225 (steady vs. last month)

- Stablecoins (context): $295.96B market value (+3.73%) across 196.57M holders (+2.17%)

Takeaway:

RWA’s macro foundation stays robust — user expansion and nearly $300B in settlement liquidity provide stability for ongoing issuance, redemption, and secondary market growth.

Treasuries: rotation, not retreat

Tokenized Treasuries maintain firm momentum above $7.5B AUM. Demand continues migrating between wrappers rather than leaving the asset class entirely.

Momentum gainers

- BUIDL (BlackRock/Securitize) up 35% MoM → $2.84B

- USTB (Superstate) up 79.9% MoM → $510M — still one of the fastest‑growing wrappers

- BENJI (Franklin Templeton) +16%→ $849M

- OUSG (Ondo) +8% → $792M

- USYC (Circle) +8% → $623M

Soft spots / rebalancing

- WTGXX (WisdomTree) –28.8% MoM → $593M

- JTRSY (Janus Henderson) –14.5%

- OpenEden TBILL Vault –17.4% MoM → $213M

Interpretation:

Treasury token inflows show selective rotation. Investors favor cost‑efficient, high‑liquidity wrappers with better cross‑chain access and distribution partners.

Private credit & carry: steady growth, smaller bases

Institutional credit and structured yield products stay crucial for returns.

- JAAA (Centrifuge) +23% MoM → $969M

- USCC (Superstate) +10.8% MoM → $254M, moderate weekly dip (–7%)

- mF‑ONE (Midas) +18.6% MoM → $149M

- ULTRA (Libeara) flat → $136M

These products attract programmatic activity from credit DAOs and managed financial firms seeking stable 10–12% on‑chain yields.

Commodities: gold leads, silver shines

Gold:

- XAUT (Tether) +84.2% MoM → $1.66B

- PAXG (Paxos) +28.8% → $1.36B

- Combined gold exposure now tops $3B on‑chain for the first time.

Silver

- SLVon (Ondo) +101.6% MoM → $7.07M — expanding as the second‑largest metal category.

Oil & others

- JSOY_OIL steady at $313M.

- XAUm (Matrixdock) up +17% MoM to $57.8M.

Insight:

The commodities segment revalidates DeFi’s hedging narrative — tokenized metals gain traction as macro hedges amid stable yield compression in credit markets.

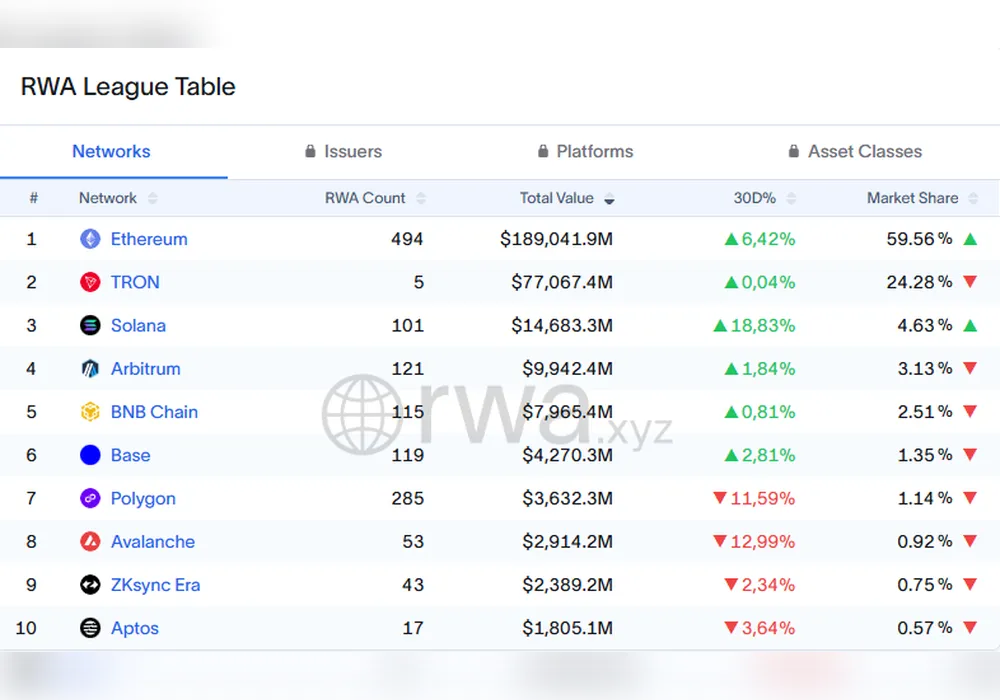

Networks & market structure

Ethereum: $12.48B (+20.7% MoM), 58.2% market share — remains RWA’s liquidity and custody anchor.

Arbitrum: $874M (+122% MoM) — explosive growth from structured fund issuance.

Stellar: $636M (+23% MoM) — stablecoin payment integrations drive steady volume.

BNB Chain: $515M (+15% MoM) — treasury‑driven inflows; rising baseline activity.

zkSync Era: $2.37B (–2.5%) — short‑term lull after prior credit issuance wave.

Polygon: $1.14B (–3.7%) — mild retreat; fewer new deals launched.

Solana: $696M (+5%) — ETF‑style equity wrappers spark interest.

Signal:

Ethereum continues as the “hub,” while L2s and alt‑L1s specialize: Arbitrum in funds, Stellar in payments, and Solana in tokenized equities.

Flows & investor behavior

- Top transfers: thBILL, PAXG, syrupUSDC, and HOODx, each around $100K, reflecting a blend of short‑duration and gold‑hedge strategies.

- Holder growth (+6.7%) outpaces dollar volume, implying smaller‑ticket participation — a healthy sign of retail diversification.

- Treasury and gold remained the two dominant use cases over the week.

What to watch next

- Treasury wrapper competition: Expect continuing fee compression and liquidity programs as USTB, BENJI, and BUIDL solidify share.

- Private‑credit pipelines: Timing of Q4 closings (Goldfinch, Tradable) will shape zkSync’s rebound.

- Metal vault expansion: Silver’s breakout could drive tokenization of platinum or diversified ETF‑style vaults.

- Chain dispersion: Can Arbitrum maintain its triple‑digit run into Q4, or does Stellar’s stable settlement niche lead the next leg?

Bottom line

RWAs cross $34B — their strongest footing yet. Growth is widespread across treasuries, metals, and institutional yield pools, while participation enlarges steadily.

The market now firmly splits into two clear lanes:

“Cash‑like” Treasuries anchoring liquidity and integrating with stablecoin rails, and “Yield‑driven” Credit & Commodities fueling on‑chain alpha.

Ethereum remains the ecosystem’s foundation, but Arbitrum, Stellar, and BNB

Chain continue proving that the RWA landscape in late 2025 is unmistakably multi‑chain, cross‑sector, and institutionally ready.