TL;DR

- On‑chain RWA market cap sets a new high at $33.89B in the last 30 days, up 10.5% and still accelerating into mid‑October.

- Holder base climbs to 481,208 (+6.6% 30d) as issuers increase to 224 and stablecoin rails expand to $293.69B (+4.4% 30d).

- Treasuries lead inflows with BUIDL, USTB, BENJI, and OUSG growing, while WTGXX lags on a 30‑day basis.

- Gold outperforms as XAUT reaches $1.31B and PAXG $1.23B, while SLVon extends a triple‑digit 30‑day surge.

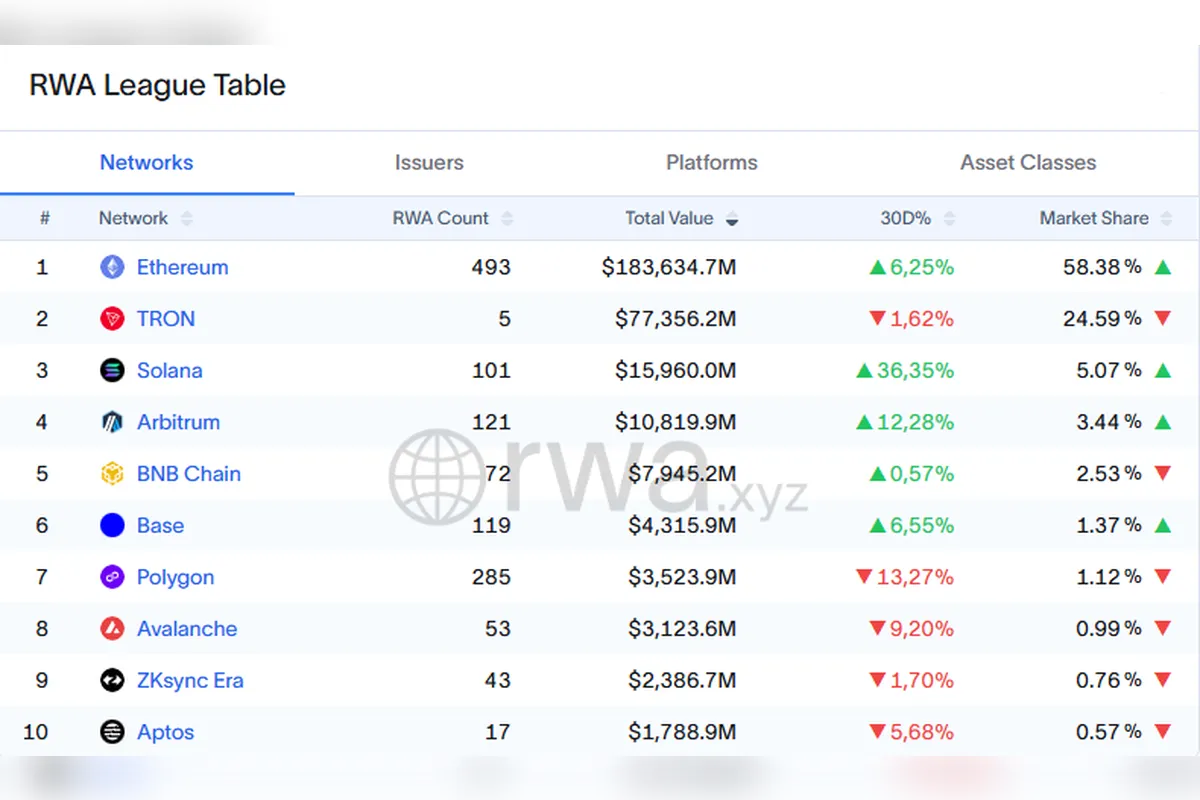

- Chains: Ethereum rises to $11.90B and 56.99% share, Arbitrum jumps to $943.8M on new listings, and Solana and Stellar post strong double‑digit gains.

Market Highlights

- Total RWA on‑chain value is $33.89B (+10.52% 30d), marking a fresh October peak and confirming broad market strength across wrappers and chains.

- Holders increase to 481,208 (+6.63% 30d), issuers reach 224, and stablecoin value climbs to $293.69B (+4.38% 30d), sustaining subscription and settlement activity.

- Transfer tape concentrates in short‑duration wrappers and gold, led by STBT at $100k, USTB at $99,991, USTBL at $99,987, and multiple PAXG blocks near $99,956.

- Ethereum’s market share rises toward 57% as absolute TVL expands, while Arbitrum’s multi‑week run lifts its RWA TVL to $943.8M (+154.7% 30d).

Market snapshot

| Metric | Value | 30d Δ |

|---|

| Total RWA on‑chain | $33.89B | +10.52% |

| Holders | 481,208 | +6.63% |

| Issuers | 224 | — |

| Stablecoin value | $293.69B | +4.38% |

Sector Trends

Treasuries leadership

- BUIDL remains the anchor at $2.82B (+28.16% 30d), while BENJI climbs to $860.0M (+14.28% 30d) and OUSG edges to $787.0M (+7.83% 30d).

- USTB sustains its breakout at $547.6M (+66.99% 30d), WTGXX recovers to $600.8M despite a −27.81% 30d drawdown, and ChinaAMC’s USD MMF stays sizable at $502.1M.

Credit, carry and alternatives

- JAAA accelerates to $911.0M (+19.07% 30d), confirming demand for senior CLO exposure on‑chain.

- USCC rises to $272.4M (+17.17% 30d) as carry strategies regain flow, with mF‑ONE at $145.6M (+44.29% 30d) and ULTRA steady at $136.4M (+35.81% 30d).

Gold and commodities

- XAUT overtakes with $1.31B (+45.66% 30d) as PAXG advances to $1.23B (+17.16% 30d), and on‑chain gold AUM surpasses $2.5B across leading wrappers.

- XAUm grows to $53.80M (+8.80% 30d) and JSOY_OIL holds near $307.2M as commodity tokens see renewed hedging demand.

Equity and ETF momentum

- EXODB debuts at $551.4M on Arbitrum, while legacy EXOD holds $256.1M, underscoring appetite for tokenized private equity and corporate exposure.

- ETF wrappers remain active: SPYon $23.88M (+50.34% 30d), QQQon $19.72M (+92.98% 30d), and TLTon $17.93M (+63.91% 30d) as 24/7 index access scales.

Leaders and movers

| Asset | Value | 30d Δ |

|---|

| BUIDL | $2.82B | +28.16% |

| XAUT | $1.31B | +45.66% |

| PAXG | $1.23B | +17.16% |

| JAAA | $911.0M | +19.07% |

| USTB | $547.6M | +66.99% |

Network Focus

- Ethereum leads with $11.90B (+13.09% 30d) and a 56.99% share as diversified issuance scales without fragmenting liquidity in core markets.

- Arbitrum climbs to $943.8M (+154.7% 30d) on credit and fund listings, while Solana reaches $685.1M (+35.68% 30d) and Stellar $640.7M (+19.94% 30d).

- Polygon eases to $1.145B (−2.72% 30d) and zkSync Era slips to $2.365B (−1.70% 30d) as flows favor L2 credit and multi‑chain ETF routes.

Forward Radar

- Institutional momentum: listings and private placements widen across L2s and alt‑L1s, with high‑grade credit and gold vaults drawing cross‑chain inflows.

- Equity and ETF tokens: watch liquidity depth on Arbitrum and Ethereum as SPYon, QQQon, TLTon, and IVVon extend month‑over‑month gains.

- Transfer tape signals: continued large blocks in short‑duration wrappers and gold suggest a “cash‑plus‑hedge” posture into late October.

Bottom line

RWAs extend to a new high with participation broadening across treasuries, credit, and commodity wrappers, while chains like Arbitrum and Solana capture incremental flows without undercutting Ethereum’s leadership. With issuance pipelines active and ETF wrappers scaling, conditions favor another strong month as portfolios lean into short‑duration yield and gold hedges.